Skrivet av Per Stolt • 31 januari, 2022 10:23

Intervjun:

INTERVJU: Dan Gibson (CIO) Sylebra Capital

Dan Gibson CIO (Chief Investor Officer), Sylebra Capital (hedge fund in Hong Kong)

Background: Sylebra Capital is Hong Kong based hedge fund with a short position in Fingerprint Cards.

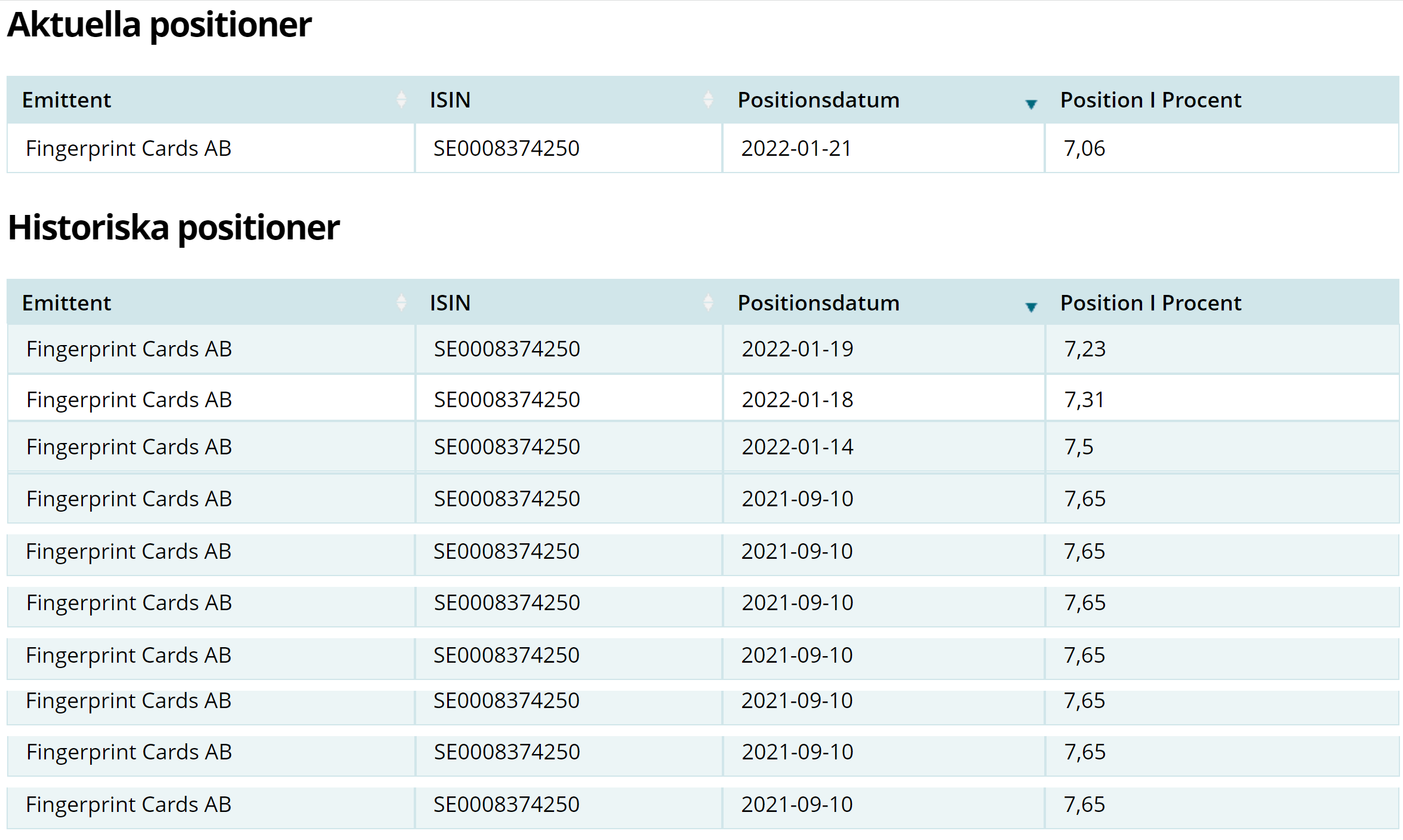

According to the Finansinspektionens register of short positions as today, Sylebra Capital has a short position of 7,06 % in Fingerprint Cards (equal to 23,03 million shares):

Finansinspektionens register of short positions for Sylebra Capital in Fingerprint Cards.

Transcript, edited ZOOM meeting:

Hi Dan, first thank you for participating in this interview – my first question is;

Who are the three largest shareholders in Sylebra and where do they come from?

Dan Gibson CIO: Our investors are global institutions, investors and pension funds mostly from the US and Europe.

Do you have any Chinese investors?

Dan Gibson CIO: Not really.

To what extent are your strategies inherited from the spirit of Julian Robertsons and Phillipe Laffont? Tell us a little about your main strategies for hedge fund Sylebra.

Dan Gibson CIO: Technically Sylebra is a Tiger grand cub. Coatue is a tiger cub, I am a spin of a Coatue, so I am a grand cub. Our strategy is fundamental oriented investing and we do things a little bit differently. We are much more mid-cap oriented versus Coatue who are mega-cap oriented, and that would probably be how we ended up in something like Fingerprint Cards. Coatue would not necessarily be involved in a company this small.

Do you have any long positions in the sector against your short position (short 7,65 %, 22.8 million shares) in Fingerprint Cards? Or any other short positions in the biometric sector?

Dan Gibson CIO: We have a very active semiconductor portfolio. You can see some of our positions in US-13-F-filings, and we do have a lot of semiconductor exposure which sends us requirements to file shorts.

We are looking at Fingerprint Cards as one of our semiconductor shorts, and it fits well against our portfolio of the other things we have.

We do not have any other positions in the fingerprint sector. For us it is not a large market as far as the players involved. It is only a handful of stocks globally that are participating in this market, given that it is fairly commoditized and doesn’t seem to be driving a lot of growth. There are not a lot of things to choose from. The other names are not necessarily interesting.

We consider us net short in that the fingerprint sector is a sub-sector within semiconductors.

Why didn’t you short IDEX which has a market cap of $340m, with only $3.0m sales, compared to Fingerprint Cards with a market cap of $657m and $148m in sales?

Dan Gibson CIO: We are not involved in IDEX. We talked to them. They seem to have a new management team and they are talking quite bullishly about their participation about some upcoming design wins and things like that.

I am not necessarily sure we have a tremendous amount of confidence in that, but if half of what they say is true, I think it would be pretty negative for Fingerprint Cards. But is it not a company which we are currently involved in.

The Fingerprint Cards stock you sold – where did you get it from and what is the interest rate for such a loan?

Dan Gibson CIO: I don’t know the rate exactly, but just let me ask my trading team and they come back and give me that. We get it from our largest global prime broker. That’s who we interact with.

It is not a very large position from a dollar basis. We manage an overall fund that is somewhere between 3-4 billion dollars under management, so 22 million dollar short is not a particularly large exposure for us, but it does work out to be a decent percentage of the company and that is kind of the outcome of what it is.

*Trading department comes back during the interview reporting an interest rate of 2 % on the name.

Is there anything like a stop-loss for this position – regarding price and time? At what point would you say – ok, we were wrong here! Or what needs to happen to change your mind?

Dan Gibson CIO: We have a fundamental case that we think is going to play out in the coming years. If you look at top line sales, the margin profile of that business. We don’t have a specific stop-loss build around that today.

But you are always constantly evaluating what you are involved in and if something moves against you, you could potentially exit.

I think you would need to see something dramatically change there, at least as far as our expectations, for us to exit the position.

Our view right now is that the market isn’t growing. That becomes a big challenge for a company that has identified themselves as a growth company, to be able to deliver on said growth.

It makes it even more difficult in the semiconductor market, where the market was very tight from a supply perspective which would be very advantageous from a margin and pricing perspective.

We been around the semiconductors markets for a long time and understand that these things work in cycles, and our expectation is that this will roll over and normalize probably in 2022, and as it happens top lines are normally not impacted but margins are significant impacted, that tends to create a difficult environment for semiconductor companies, and Fingerprint won’t be able to get around that.

In many other cases where you had a short position – it eventually led to a structure deal. Is this something you are deliberately involved in? As a strategy? Because it seems to have happened in many of your earlier short positions, for example:

1: September 2 2021 BLUE PRISM GROUP (UK)

2: July 7 2021 FINGERPRINT CARDS (SWEDEN)

3: Feb 8 2021 DIALOG SEMICONDUCTOR

4: January 10 2020 JUST EAT (UK)

5: Nov 9 2020 COUNTRYWIDE PLC

6: February 11 2019 TECHNICOLOR (France) received a binding offer on its research

7: June 13 2017 MONITISE PLCE (UK)

Dan Gibson CIO: I think we have to look at them individually.

Blue Prism is a company that we shorted, the stock had a significant run. We looked at it and said it was pretty unhinged from fundamental values. So then we shorted it.

Business results ended up being quite disappointing and the stock collapsed. We exited. Our evaluation was that the valuation properly had adjusted and the prospect going forward was a lot less attractive on the short side, so we got out of the position. They suddenly became the take-over target and then somebody came in and bought them.

That’s not uncommon in the world of stocks that collapse, generally for some of these public market traded companies they reach a price point where maybe public market investors are no longer excited to own them, but maybe some financial owners or a strategic owner find it more interesting.

It’s why valuation is the key component of looking at things and constantly assessing your risk reward and things.

Fingerprint Cards we are obviously still involved in.

DIALOG SEMICONDUCTOR I mean, that again, is another kind of company that is fairly commoditized, they wanted to exit that business, essentially, and they sold that business to Apple.

Wasn’t necessarily driven by us or anything, it just happened to be the outcome there.

JUST EAT (UK), COUNTRYWIDE TECHNICOLOR, MONITISE PLCE

Just Eat got acquired in a pretty similar situation. After business was operating quite poorly, market dynamic was getting worse, and investors didn’t seem to be aware of that.

COUNTRYWIDE pretty bad outcome

TECHNICOLOR, MONITISE PLCE stocks basically just imploded, and I don’t know where Monitise ended up, I don’t even think it is currently listed. But I do remember the stock going down dramatically and Technicolor had a similar outcome as well, but technicolor is still public so I think they might have sold off a division or an asset which might have helped them.

Does this mean, according to what you just said, that there could be a structure deal in Fingerprint Cards too?

Dan Gibson CIO: Oh, generally we are usually gone by the time they are cheap enough that somebody wanna come in and buy them. I don’t think any strategic deal is going to happen soon because the stock is still very expensive.

You haven’t gone through that painful re-rating process yet, where you get to that point where someone maybe gets interested in acquiring the asset.

According to an earlier interview in Sweden you said you believe that the biometric payment card market won’t happen, or at most become a niche. What are your arguments for that?

What kind of events or information supports that kind of take?

Dan Gibson CIO: Yeah. That’s interesting, I didn’t know If anybody was going to see that interview. Our view on the biometric market, at our core, we are technology investors, I spend most of my time on early stage companies and evaluating those.

I look at the biometric market as a market that has a lot of the characteristics that you would typically see for something that ends up being a niche.

What I mean by that; the first thing that drives technology is usually some sort of compelling – an overwhelming ROI from a product perspective.

Because you need that to really inspire people to do something differently than they historically have done.

I think if you look at it from a bank’s perspective what biometrics cards do, it is really not compelling, and the ROI associated with it is certainly not compelling.

You also mentioned that only a Chinese player can win the mobile biometric fight. Why is that?

Dan Gibson CIO: It is a commoditized product. There is not a lot you can do from a formfactor perspective or a technology perspective to put more into the fingerprint sensor. You don’t have enough innovation to keep away those guys that are going to commoditize what you are already doing, basically reverse-engineering your products.

The market is going to watch ASP and it is basically going to go to the lowest-cost-providers. That will be the Chinese guys and not a European supplier.

How much would you say the biometric market for payment (cards) is worth 2025 and how big will Fingerprints market share be estimated at?

Dan Gibson CIO: I think it is going to be a tiny market, it will be small enough that it won’t matter what Fingerprints market share will be.

What is your take on inflation, stock market and Bitcoin?

Dan Gibson CIO: Obviously inflation is a very typical topic at this point.

I think most people don’t understand inflation and the drivers of it, and what can stop or prevent it. We are stock-pickers so we don’t have a general market view.

What advice can you give to our readers – how do you get successful in the financial market?

Dan Gibson CIO: If your readers are retail oriented, I would just caution them, financial market is a dangerous place, especially for people who don’t have a lot of experience, so I would definitely recommend that you take a lower risk approach so that instead of necessary betting on individual companies that you never talk to, you don’t understand the technology, you done too little research on you are much better and safer putting your money into index funds ETF:s of sectors that you like, things like that, which if you hold them long enough are more likely to generate pretty decent return.

Thank you Dan for giving us the opportunity to do this interview!

This is interview is free for all to read. Please support your digital newspaper Dagens Börs with a small contribution, to help us continue create interesting material.

Dagens Börs, Swish: 123.504.1959

Dagens Börs, bankgironummer: 740-0138

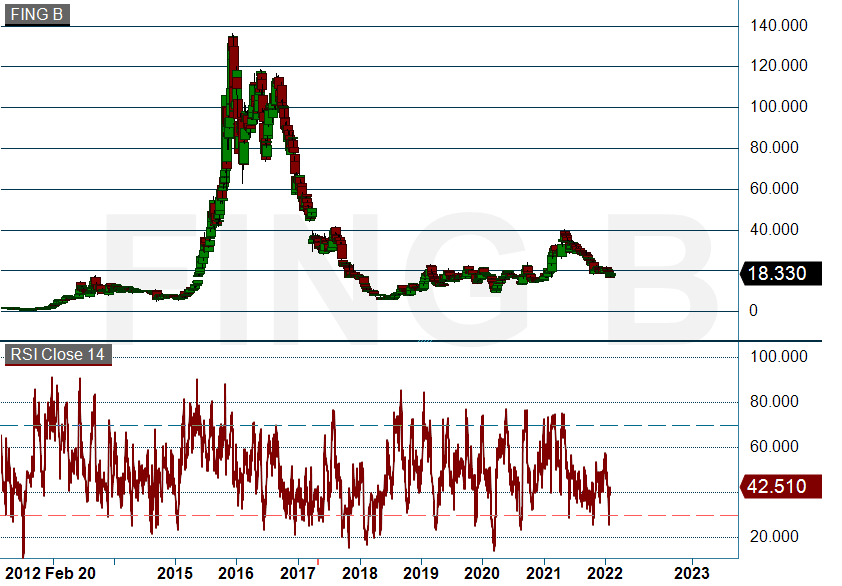

Fingerprint Cards (infront)