Skrivet av Per Stolt • 11 februari, 2022 16:10

Intervjun:

INTERVIEW: John E. Skajem (CEO) Huddlestock

John E. Skajem (CEO) Huddlestock

Huddlestock Fintech delivers innovative technology solutions to the capital markets, treasury and wealth management industries. Today we will have a chat with Huddlestock’s CEO John E. Skajem, who will tell us more about Huddlestock’s expansion plans and how they will make money.

What is Huddlestock?

John E. Skajem (CEO) Huddlestock: Huddlestock Fintech is a Norway-based disrupter of wealth management and retail trading, delivering innovative software-as-a-service (SaaS) solutions for custody banks, wealth managers, and retail trading platforms. Our range of solutions allow customers to digitize their wealth management and trading processes, lowering costs and increasing efficiency and customer retention. Our offering includes the end-to-end wealth management solution Apex, the white labelled, API-based trading solutions Bedrock and Canyon. In addition to this we have an excellent relationship with Calypso. Alongside our software solutions we offer expert technology advisory to large and small financial institutions.

We are proud to be listed on Euronext Growth Market and we were Norway’s first Fintech to be publicly traded. We have local roots in Stavanger on the West coast of Norway and with global ambitions. We have local offices in Stockholm, Copenhagen, Oslo, Munich and Kuala Lumpur.

How is your platform different from the competition?

John E. Skajem (CEO) Huddlestock: Huddlestock has three advantages to its competitors:

- An end-to-end solution; Although there are many trading and wealth tech solutions on the European market, we find that there is no comparable competitor that could offer a full end to-end solution like Huddlestock’s. The uniqueness of our solution is the complete integration of our ecosystem; direct market access through liquidity providers, regulatory license and platforms for trading and wealth management.

- Direct Market Access with world-leading banks; Our partnerships with BNP Paribas and Baader Bank are key to our offering. Through these partners we can offer our customers a direct connection to global markets. We also partner with other well-known global liquidity providers such as Tradegate and Interactive Brokers, etc.

- A world-class technology-first consulting team; with 30 expert consultants specialized in technical implementation of treasury and capital markets solutions we are well placed to punch above our weight. We are very proud of our team. They have helped well-known large banking groups in the Nordic with strategic planning, project management, pre- and post-implementation, customization projects, technical and business analysis, treasury management. In teams and individually, they have successfully led large teams through transformational digital change.

Who is John E. Skajem – tell us a little about yourself!

John E. Skajem (CEO) Huddlestock: I am Norwegian born with strong international outlook. Over the last 30 years, I have worked with most financial products across global capital markets. I started out on the Chicago Mercantile Exchange as a trader, went on to become a broker and fund manager, ending up as JP Morgan’s Country Head for Norway and part of their European leadership team. As you can imagine, I have long and deep experience across the asset management, investment banking and capital markets spaces. And that around the world; in Chicago, London, Paris and Oslo. After more than 30 years in the financial services industry, I was very pleased and proud to be offered the opportunity to become Huddlestock’s CEO, lead its exciting journey and grow together with our international teams!

How do you make money?

John E. Skajem (CEO) Huddlestock: As a Software-as-a-Service company, Huddlestock’s business model is highly scalable. We deliver revenues from both ongoing revenues (assets under management, trading revenues, license fees) and bespoke consultancy projects that can be one-off in nature or longer term. Our book is mainly based on long term, repeat business.

Revenues increased during Q4 – tell us what it was due to!

John E. Skajem (CEO) Huddlestock: We were delighted to deliver a fantastic set of results to the market. Not only did we beat our own guidance and those of analysts, we literally doubled our revenues from Q3 to Q4! While this was mainly driven by very strong momentum in our advisory business, we were happy to report an increase in recurring revenues within our software segment. Following the reorganization in Germany at the end of November 2021, we reassessed our commercial portfolio and we are now very focused on delivering on our priority client contracts to show our shareholders and clients what a fantastic products we have!

What does your plan look like to grow?

John E. Skajem (CEO) Huddlestock: We see many avenues for growth; in the near term we are planning to grow geographically; in Germany and the DACH region, and in the Nordic countries. In the medium-term, we would like to expand from our current base in Malaysia, targeting private banking havens such as Singapore, as well as faster growing economies such as Indonesia and Vietnam. We are further looking to extend our proprietary ecosystem of partnerships. Respecting the UN Global Compact charters, we are keen on partnering with likeminded Fintechs. An important pilar in our growth plan is to attract the right talent. In the immediate, we are looking for individuals with strong technical skills and within business development.

Who are your typical customers?

John E. Skajem (CEO) Huddlestock: Our customer base is broad. We are focused on the following three use cases:

1) Retail trading platforms: typical customers are FinTech’s, banks looking to launch their own trading, savings, and/or investment application;

2) Wealth managers looking to digitize their client experiences, these could typically be housed within private banks, larger retail banking groups with in-house wealth departments, or groups of independent wealth managers looking to digitize their internal workflows and enhance customer experiences;

3) Market places, including super apps, ecommerce merchants, news websites/portals, etc. looking to extend their customer service offer by embedding an investment and savings solution within their existing platform.

Which geographic markets do you turn to?

John E. Skajem (CEO) Huddlestock: Europe is our home market and we are currently active in Northern Europe, most notably in Norway, Sweden, Denmark and Germany. In the future, we envisage increasing our presence in many more European markets.

Outside Europe, Asia is a very exciting (and diverse) region. We are already active in Malaysia and are considering options for expanding into developed markets such as Singapore and Australia, but also into faster growing emerging markets including Indonesia and Vietnam.

Do you have any financial goals?

John E. Skajem (CEO) Huddlestock: When we acquired Visigon last year we set out an end of year target. Having just acquired a company it felt right to give this target. We have not set out a target for 2022. At this stage of our journey, delivery on technology contracts is more important than giving a short-term financial goal. And this is what we are all working towards. For the medium-term it totally makes sense to have targets and we have set ourselves a medium-term NOK 200m revenue goal.

Do you see any possible need for new capital raising in the next year?

John E. Skajem (CEO) Huddlestock: We just closed a successful private placing of approximately NOK 25 million in December 2021. We are very happy about this. Going forward we are completely focused on operational delivery of technology contracts and on meeting client demand within our advisory business. That said, we do have a stated policy of making selective, shareholder friendly deals. Should the right deal come our way that makes strategic, operational and financial sense, asking our shareholders for support makes absolute sense.

What are Huddlestock’s most important challenges over the next year?

John E. Skajem (CEO) Huddlestock: One of our most important challenges as we position ourselves for growth and scale, is to attract the talent we need to deliver on (i) the strong demand we see within our expert technology advisory business and (ii) the opportunities the demographic shift within wealth management provides for taking market share across Europe and Asia. In the future, more and more people will engage with financial services through platforms. Embedding a Huddlestock trading solution alongside your other financial services offering makes sense. As a financial intermediary, adding services to your client offering allows you to win a higher percentage of your customers wallet. Choosing to enhance your customer experience with a wider range of products makes sense!

Thank you so much John for that interesting and promising intereview!

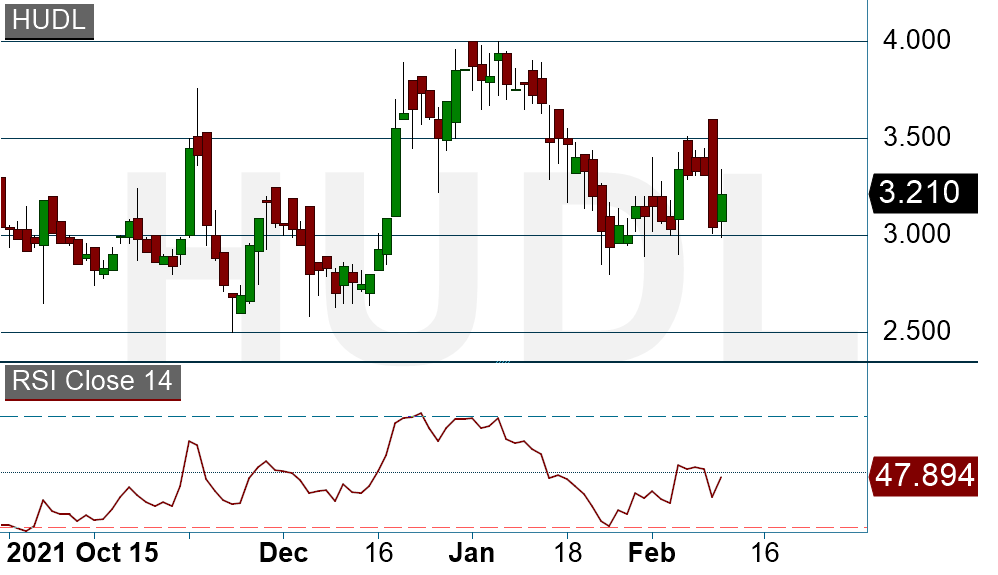

Huddlestock dagsdiagram (diagram källa: infront)