FING: Sylebra involved in 7 buyout/talks?

Skrivet av Per Stolt

13 september, 2021 05:07

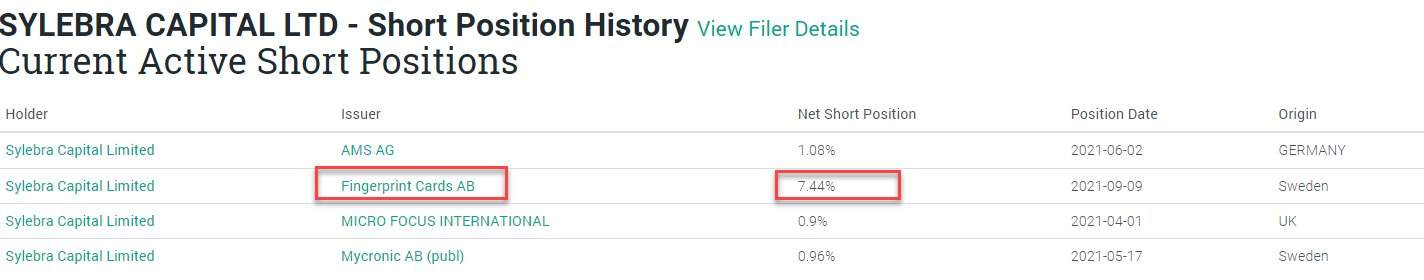

The Hong Kong based hedge fond ”Sylebra” has made a stab at one of Swedens midcap companies Fingerprint Cards, by initiating a short position.

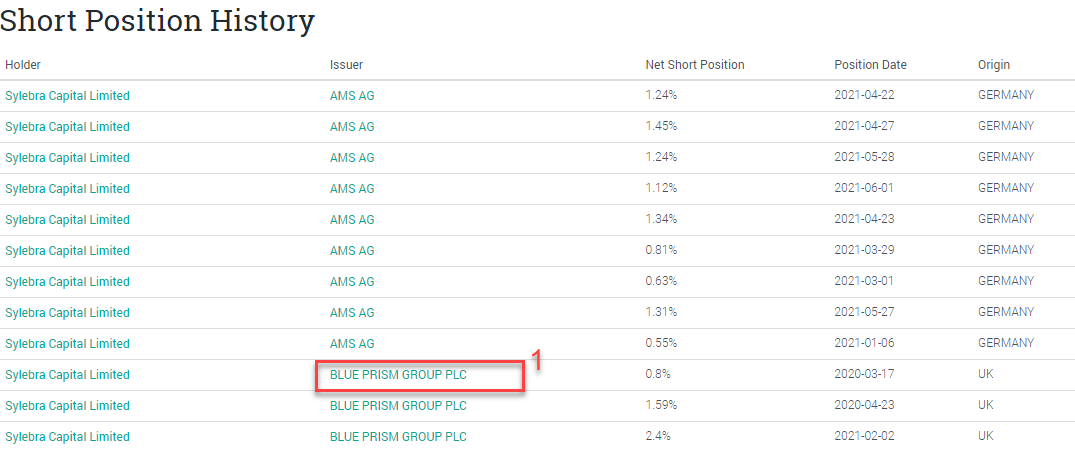

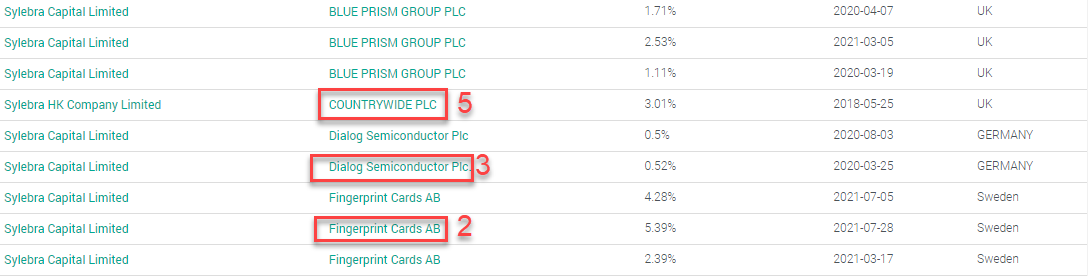

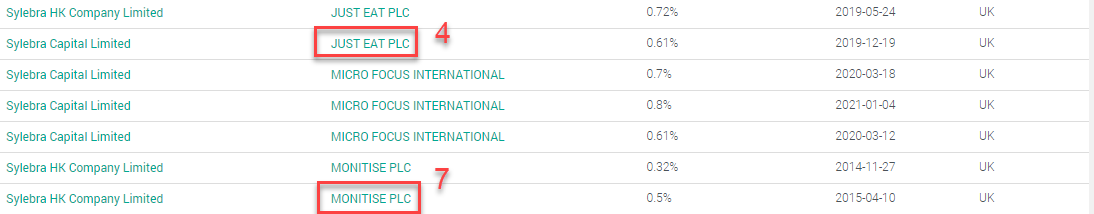

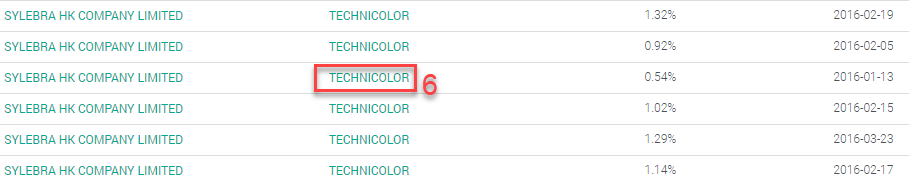

As we can see Sylebra has not too many short positions current active. But back in time they had a few and 7 of the might have been involved in a buyout or talks.

Sylebras current short positions

Despite a few number of short positions we can found a surprisingly many number of times the hedge fund being involved in a buy-out, hostile bid, take over-discussions, for the full och part of a company.

Given that the record from whalewisodom.com is correct Sylebras short positions through time can be seen as:

List above: Some of the chinese hedgefund Sylebra short positions.

Source: Whalewisdom.com

1: September 2 2021 BLUE PRISM GROUP (UK)

Source: https://www.cnbc.com/2021/09/02/uks-blue-prism-becomes-latest-target-of-us-private-equity.html

2: July 7 2021 FINGERPRINT CARDS (SWEDEN)

Source: https://mfn.se/one/a/fingerprint-cards/fingerprint-cards-ab-publ-board-of-directors-initiates-strategic-review-68818192

3: Feb 8 2021 DIALOG SEMICONDUCTOR

Source: https://www.tipranks.com/news/dialog-semiconductor-in-6b-takeover-talks-by-renesas-electronics/

4: January 10 2020 JUST EAT (UK)

Source: https://www.news24.com/fin24/companies/retail/takeaway-wins-bidding-war-for-just-eat-with-8bn-offer-20200110

5: Nov 9 2020 COUNTRYWIDE PLC

Source: https://www.theguardian.com/business/2020/nov/09/countrywide-estate-agents-takeover-bid-connells-alchemy

6: February 11 2019 TECHNICOLOR (France) received a binding offer on its reaserch-innovation

Source: https://www.technicolor.com/news/technicolor-has-received-binding-offer-its-research-innovation-activity-interdigital

7: June 13 2017 MONITISE PLCE (UK)

Source: https://newsroom.fiserv.com/news-releases/news-release-details/fiserv-announces-firm-offer-acquire-monitise-plc

In 7 case out of 13 the Chinese hedge fund Sylebra carried a short position, almost exactly in proper time before a merger, part buy-out, bid or a negotiation around it, took place, according to whalewisdom.com.

The market is now waiting for Fingerprint Cards ”strategical overview” which was triggered buy some external interest for the company:

”…We are reviewing different alternatives, which could range from acquisitions, to spin-offs, sales and new listings”,”…There has been considerable interest for Fingerprints from a number of different players, which has triggered the review process”, Johan Carlström – Chairman of the board said in a pressrelease July 7 th 2021.

This article is not locked and can be read by both subscribers and non-subscribers.

Dagens Börs would like to emphasise that the chines hedge fond Sylebra has not done any illegal or are subject to any lawsuit or claim. Initiating a short position is not illegal.

The author have no position in the company.